There’s a few things you should you know before deducting donations on your taxes If you take itemized deductions on your tax returns, making charitable cash or in-kind donations are a great way to lower your tax burden. However, not…

There’s a few things you should you know before deducting donations on your taxes If you take itemized deductions on your tax returns, making charitable cash or in-kind donations are a great way to lower your tax burden. However, not…

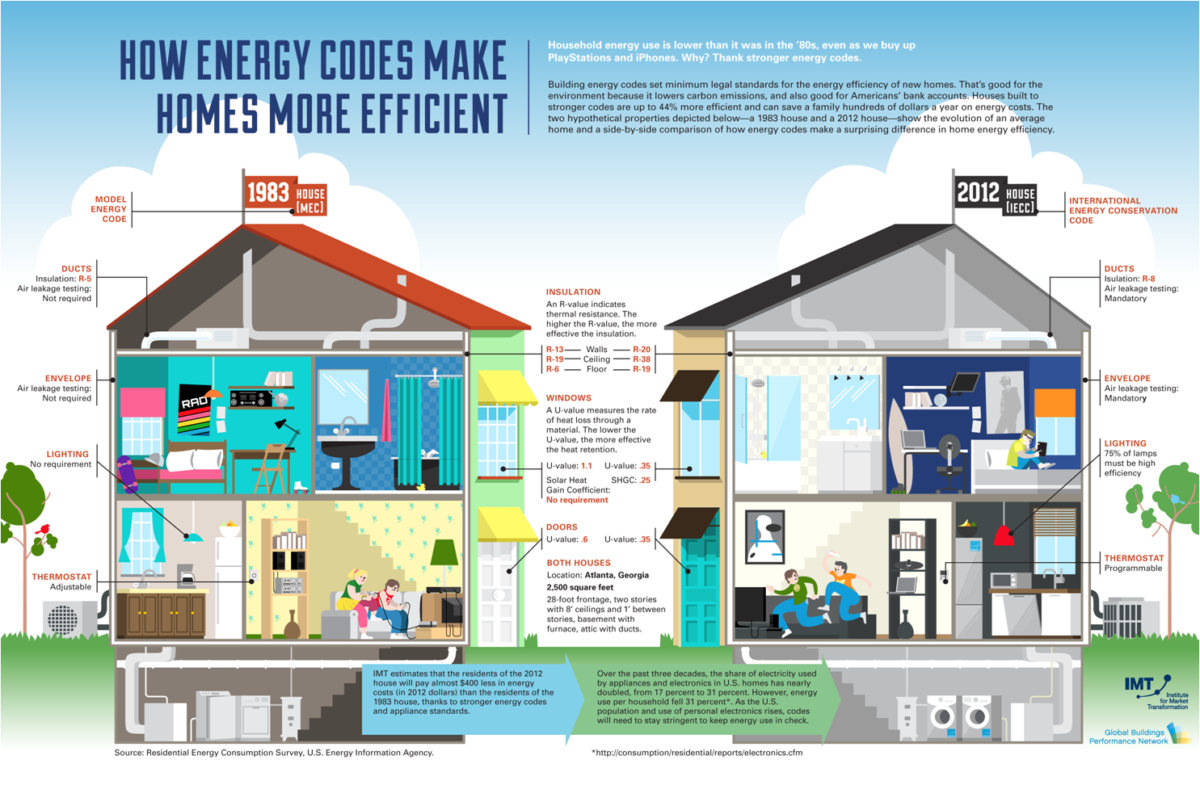

[su_youtube url=”https://www.youtube.com/watch?v=LkH-9wwFzuM” autoplay=”yes”] Upgrades to home or home business can save on energy costs as well as a tax deduction Little know state tax deductions are available for homes that are energy efficient. These energy efficient upgrades include windows, solar…

From the IRS Wire [su_youtube url=”https://www.youtube.com/watch?v=ghQp0DxzY6g”] Excessive Claims for Business Credits Makes the IRS “Dirty Dozen” List of Tax Scams The Internal Revenue Service today warned that taxpayers should watch for improper claims for business credits, which…

In order to better combat fraud, the IRS announced that taxpayers that claim the Earned Income Tax Credit (EITC) and/or the Child Tax Credit (CTC) will have to wait a little bit longer for their tax refund check or deposit. This new law only…

People wanting to help Orlando victims targeted by fake charities The IRS issued a press releaseBe warning of an increase in scammers targeting people wanting to help Orlando victims. Such scammers position themselves as fake charities hoping to obtain cash…

We here at Finerpoints Accounting are committed to bringing you the latest information on scams involving income taxes that may arise. The newest one that seems to be popping up from the IRS involves phony emails to HR and Payroll…

Every year we inform you of the IRS’ Dirty Dozen Tax Scams. as every year the IRS updates their list to give you the 12 most common scams or frauds you’ll encounter. 2016 hasn’t brought out many changes, you’ll still…

Tax Tip: Deciding Whether to Itemize or Use the Standard Deduction IRS Newsfeed Today’s tax tip is a common question that we get from many filers on what they can deduct on their taxes. For many easy tax filers (i.e…

If You Missed the Tax Deadline These Tips Can Help April 15 has come and gone. If you didn’t file a tax return or an extension but should have, you need to take action now. Here are some tax deadline…

Top Six Tax Tips about the Home Office Deduction If you use your home for business, you may be able to deduct expenses for the business use of your home. If you qualify you can claim the deduction whether you…